Deadly Declines

Causing Customers and Profits Flying Out the Door.

Navigating the Complexities of Authorization Declines in Payment Processing

In the intricate realm of payment processing, “Authorization Decline” is a term that evokes a multifaceted narrative, one that speaks to the efficiency of transaction systems, and yet signals a friction point in the consumer experience. To industry veterans, an authorization decline is a familiar encounter. Still, the layers of its occurrence and resolution require a deep dive into the operational matrix of payment networks, and issuing financial institutions as to why certain transactions get approved while others are declined.

Understanding Authorization Declines

At its core, an authorization decline occurs when the cardholder's issuing bank or card network does not approve a transaction request. This rejection can stem from a constellation of reasons, including but not limited to insufficient funds, exceeded credit limits, incorrect entry of personal details, expired cards, or suspicion of fraud. It is crucial to differentiate an authorization decline from a processing error or a timeout (an “Exception Decline”). An authorization decline is a deliberate response, a risk management measure employed by the card issuer to prevent potentially problematic transactions and/or limit their financial liability for non-payment by the consumer.

The Analytical Perspective

From an analytical standpoint, authorization declines serve as a barometer for the efficacy of a merchant’s payment acceptance systems and the financial health of their customer base. High rates of decline may signal a need for enhanced customer communication regarding transaction practices, or a review of the risk parameters set by the issuing banks. For financial institutions, declines are indicators of risk management performance, but they can also be symptomatic of overly cautious fraud prevention settings that may inadvertently hinder legitimate transactions.

Implications for Merchants

Merchants bear the brunt of the immediate consequences of authorization declines. Each decline is a missed opportunity for revenue, a potential disruption to cash flow, and a risk of diminishing the consumer’s shopping experience and loyalty. The merchant must navigate this terrain astutely, ensuring their payment systems are optimized to facilitate successful authorizations while providing clear guidance to customers when declines occur. Minimizing authorization declines involves a proactive, data-driven approach.

Merchants can employ several strategies:

Data Accuracy: Ensure transaction data is captured accurately. Simple errors in card numbers, expiration dates, or security code entries are common culprits for declines.

Clear Communication: Provide clear error messages to customers. If a decline occurs, an intelligible message can guide the customer to try an alternative payment method or to contact their bank.

Fraud Management Tools: Implement advanced fraud management tools that can help in distinguishing between legitimate transactions and potential fraud with more precision.

Conclusion

Authorization declines are an inevitable aspect of the payment process but understanding and addressing the underlying reasons can significantly reduce their occurrence. For merchants, a robust strategy to minimize declines is not only about protecting revenue but also about enhancing customer satisfaction and trust in their payment systems. Ultimately, a merchant's approach to managing authorization declines reflects their dedication to providing a seamless and secure transaction environment. Working with companies like Payometry, specifically designed to provide detailed logic capability to avoid and remedy declines once received, is a great 1st step. In an era where transaction experience can differentiate businesses, a nuanced understanding of authorization declines is indispensable for anyone operating within the payment processing ecosystem.

Blind Items

These are two age demographics that are most concerned about high costs this Holiday Season. If you’re in this group, you probably already feel it. If not, their identity may surprise you.

This hit Bravo TV show is about to partner with a very high-profile retailer to try a new retail phenomenon. Will you be enticed to purchase from their guests or crew?

Innovation Inspiration

Embracing the Cash Trend: Opportunities for FinTech in the Australian Market

The Persistence of Cash in Australian Travel

In a world increasingly moving towards digital transactions, a recent study by Travelex offers a surprising insight: over half of Australian travelers still prefer cash as their primary means of foreign currency exchange. This study, involving surveys and in-depth interviews, reveals that 52% of Australians opt for cash during overseas trips. Interestingly, this preference is most pronounced among younger travelers, with 62% under 25 years old favoring cash over other forms of payment. This trend is not just a fleeting preference; it signifies a resilient, albeit traditional, market segment within the foreign exchange (FX) sphere.

Planning and Satisfaction in FX Transactions

Another facet of the study highlights the meticulous planning Australians undertake for their overseas spending. 87% of respondents plan their FX needs well in advance, with over half starting the process a month or more before their trip. This advance planning correlates with higher satisfaction rates, especially among those who purchase foreign cash before traveling. In contrast, last-minute currency exchange at airports or using credit cards often leads to dissatisfaction due to higher fees and unexpected charges. This data underscores a vital point: the experience of obtaining foreign currency significantly impacts customer satisfaction.

Opportunities for FinTech Innovation

For FinTech companies eyeing the Australian market, these findings present unique opportunities. Firstly, there's a clear demand for solutions that offer a seamless, cost-effective way of obtaining foreign cash. Digital platforms that allow travelers to order and manage foreign currency with transparent fees could significantly disrupt the current market. Additionally, there's a substantial interest in digital FX products that provide real-time conversions to AUD, highlighting a preference for transparency and ease of use. FinTech firms could capitalize on this by developing apps or services that not only offer currency exchange but also integrate budgeting tools and real-time spending analytics, tailored specifically for the Australian traveler.

In conclusion, while the global trend leans towards a cashless society, the Australian market reveals a strong attachment to cash, especially among younger travelers. This opens a realm of possibilities for FinTech firms to innovate in delivering convenient, transparent, and cost-effective foreign exchange solutions. By aligning with these consumer preferences and behaviors, FinTech companies have the potential to revolutionize how Australians handle foreign currency during their travels.

Also, Consider …

Research conducted by Travelex reveals significant insights into the behavior and preferences of Australian travelers regarding foreign exchange (FX) and spending habits while abroad:

Cash Usage Remains High: A notable 52% of Australians still prefer using cash as their primary foreign currency method, either withdrawing it at their destination or airport or purchasing it beforehand. This trend is particularly pronounced among younger travelers, with 62% of respondents under 25 years old favoring cash.

Advance Planning: Most Australians (87%) plan their overseas spending in advance. This planning occurs at different times: 51% do so a month or more before traveling, 26% a few weeks prior, and 10% only a few days before their trip. Those who plan ahead and purchase foreign cash before traveling generally report higher satisfaction levels due to avoiding costs and fees associated with airport currency exchange or ATM withdrawals abroad.

Satisfaction with Pre-Planning: Pre-planners tend to have a more positive FX experience. 64% of those who obtained foreign cash before traveling were satisfied or very satisfied, contrasting with those who bought cash at the airport or used credit cards and faced higher fees.

Behavioral Shift During Travel: While Australians are price-conscious and well-informed before traveling, their focus shifts during the trip. Enjoyment becomes a priority over budgeting, and many tend to exchange more money if they run out, rather than sticking to a preset budget.

Preferences for Digital FX Products: When it comes to digital FX solutions, transparency is key. 84% of customers prefer knowing the AUD equivalent of their overseas spending. Additionally, 71% favor the option to exchange and hold foreign currency until needed, and 64% appreciate the convenience of ordering foreign cash through an app and picking it up at their destination.

These findings highlight the continuing importance of cash for Australian travelers, especially among younger demographics, and the shift in consumer behavior from pre-travel planning to a more relaxed approach during the trip. They also underscore the growing interest in digital FX solutions that offer transparency, flexibility, and convenience.

Deal of the Week

The Holidays are HERE! Save Time. Save $50 w/ coupon. Arriving This Week: 6.5 ft Pre-Lit Artificial Christmas Tree for a Magical Holiday

Discover the perfect solution to infuse your home with the enchantment of the holiday season. Our artificial Christmas tree brings you the warmth and charm of a live tree without the hassle of maintenance, allowing you to embrace the joy of the holidays effortlessly.

Effortless Elegance: This 6.5-foot Honeywell Pre-Lit Artificial Christmas Tree offers the beauty of a real tree without the need for watering, shedding needles, or any upkeep. It's the ideal centerpiece for your holiday decor.

A Festive Atmosphere: Transform your living space into a festive wonderland with ease. Our thoughtfully designed tree is pre-lit, sparing you the time and effort of stringing lights. Enjoy the radiant glow of the season effortlessly.

Experience the magic of the holidays with the Honeywell Pre-Lit Artificial Christmas Tree. Order now and make this holiday season truly memorable!

【6.5 Feet of Festive Elegance】Elevate your holiday decor with our 6.5-foot Frances Cashmere Pre-Lit Christmas tree. Standing tall with a generous 44-inch base diameter, it sets the perfect stage for a joyful celebration.

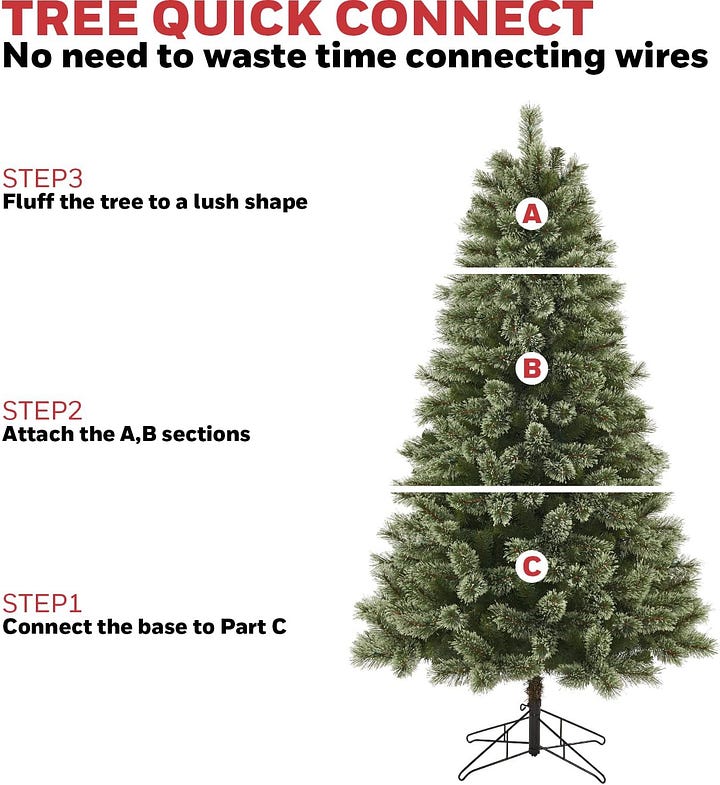

【Effortless Setup and Space-Saving Storage】Experience the simplicity of assembly and the convenience of storage thanks to our patented One Plug Quick Connect Technology.

【Illuminate and Inspire】Elevate your holiday ambiance with our Christmas tree, featuring a built-in tree top connector that effortlessly complements your stunning theme. Easily connect a lighted tree topper without the need for cumbersome extension cords.

【Robust and Secure】Crafted with 811 premium PVC/Cashmere tips and reinforced with sturdy metal hinges, our Christmas tree boasts thick, lush branches that emulate the look of a natural tree. Complying with stringent safety and sustainability standards, this tree is UL-certified for your peace of mind. Its flame-retardant material ensures safety, durability, and reusability, making it a reliable addition to your festive celebrations.

【Create a Magical Holiday Ambiance】Elevate your holiday experience with our artificial Christmas tree featuring 250 UL-listed Color Changing LED lights. With 4 lighting functions designed to streamline setup and eliminate the need for connecting multiple light strings, you can effortlessly infuse your home with a captivating festive glow. Welcome the spirit of the season and turn your home into a breathtaking Christmas wonderland with the Honeywell Pre-Lit Artificial Christmas Tree!